Precision Guided Selling in action

The Future Model of Sales: Aligning Value Creation and Value Capture To Drive Results

By Benny Shoham, Strategic Relationship Manager, SAFC and Carrie Welles, Partner, 5600blue

The sales game has changed. The world has experienced a digital revolution, and now management priorities, customer needs and competitive advantages all change in real time. Many customers are now more knowledgeable than the people selling to them. Traditional sales solutions – training, marketing, CRM products – just aren’t cutting it anymore. Today’s sales teams need a better way to sell: a fundamentally different way to sell that enables them to take full control of the sales process.

That is exactly the conclusion we came to at SAFC when we realized we needed a new approach to engaging with our customers as a growth partner and growth engine – because our accounts were facing the most significant challenges in their industry in years. This is the story of how SAFC, a manufacturer and distributor of specialty chemicals for the biopharmaceutical, pharmaceutical and high-tech industries, found and implemented that approach with one strategic account, resulting in a $8 million win for our company.

The background:

SAFC customers are researchers, engineers and commercial manufacturers tasked with bringing to market the next generation of medicines, vaccines and advanced technological applications. This story illuminates one of our largest strategic pharmaceutical accounts (“PharmCo”), a producer of children’s vaccines. In 2012 our customer was on the edge of the dreaded “patent cliff,” with patents about to expire on a number of its leading drugs.

Faced with aggressive competition from generics and an overnight drop in revenue, PharmCo had begun ramping up pressure on its suppliers. At the same time, our executive leadership had given our strategic accounts program a mandate to grow at 1.5 to two times the pace of the market and to co-create innovative solutions with a selection of strategic accounts in our Life Science division. With pressure mounting, we knew we needed to “step up our game” to a new way of selling and negotiating with our customers.

The solution:

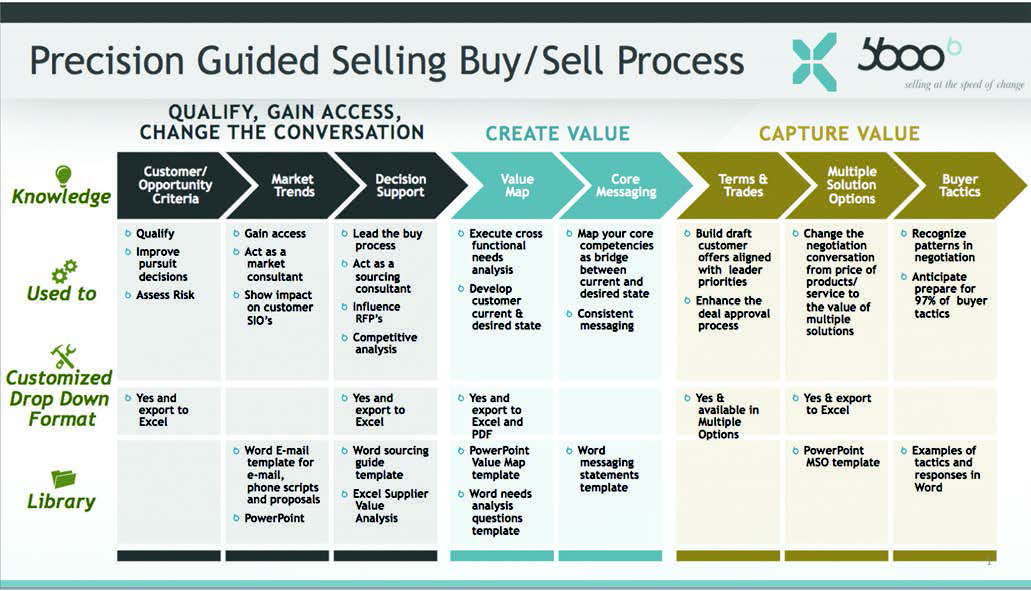

We hired 5600blue, a global consultancy, to assist with this pressure by implementing their Precision-Guided Selling buy/sell approach, a solution that has three parts:

• Providing the SAM team with real-time customized market knowledge throughout every phase of the buy/sell process

• Supplying us customized software technology that houses, distributes and updates this knowledge in consumable ways like Word, PowerPoint and email formats to help the team craft compelling messaging

• Delivering us customized enablement through in-person sales training and a follow-up formal coaching program

The real-time knowledge is mapped to the three main phases of the buy/sell process: (1) qualify and gain access, (2) value creation and (3) value capture. This is how the data is organized and used.

5600blue worked for four months with our cross-functional leadership team to mine best practices, and to organize and create all of the knowledge that exists in our software tool.

Background on SAFC’s history with the strategic customer:

This initiative became particularly important for us because of the volatile tactical-strategic-and-then-back-to-tactical relationship we had experienced with PharmCo, whose status as a strategic account dates back to the birth of our program in 2010. Early on, we moved quickly from a tactical relationship to a strategic one after we won a significant contract and worked collaboratively on projects. That lasted for almost three years, until 2012, when the patent cliff arrived and our customer lost its patent on a drug worth billions of dollars in revenue.

At the same time, the company’s executive team underwent a rash of personnel and structural changes, which dipped down into the operational level as well. Overnight, our account team found itself starting over with a new slate of customer contacts, who held a significantly different outlook on the relationship. Notably (and most troublingly), PharmCo introduced a new gatekeeper and owner of the overall relationship: the chief procurement officer.

Across-the-board cost cutting and change in projects and priorities at PharmCo led to a significant reduction in revenue for us. In short, we’d found ourselves mired in a tactical relationship with a customer we considered strategic. The following is the story of how we climbed back to strategic supplier status with PharmCo, winning $8 million in new business as a result.

5600blue’s process comprises three parts.

1. Qualify and gain access

Qualify, i.e., choose the customer opportunity wisely

As we looked at implementing the Precision-Guided Selling process, the first thing we needed to do was to be sure the opportunity we would spend precious resources on was a worthy one. What we needed was a business opportunity that could help us break free from our tactical position and allow us to engage higher, deeper and wider at the account.

The opportunity we settled on involved raw materials for children’s vaccines. It checked a majority of the boxes on our ideal customer criteria list with favorable attributes like biological pipeline growth, significant revenue potential, new business, alignment with our technical expertise, clearly defined scope and opportunity to maintain our intellectual property.

Gain access, i.e., create demand

With the right opportunity targeted, we set out to create demand for our solution. Early in 2014 we confirmed a market rumor that PharmCo’s single source for serum, a critical raw material used in vaccine production, had lost control of a significant share of its supply chain. If not addressed, the potential impact to PharmCo would have been a supply shortage, significant price increases and quality gaps.

Because of the complex and arduous process for bringing a new vaccine to market, which can take 10 to 15 years, the consequences of a supply-chain disruption for PharmCo could be catastrophic. Just the process of qualifying materials from a new supplier can take 18 to 36 months, at significant cost to the applicant.

We went to work quantifying the impact this serum shortage would have on our customer and created compelling, attention-grabbing messaging for the stakeholders. Rough estimates showed that every month of shortage could result in millions in lost revenue to our account, not to mention the impact to its brand.

Given that PharmCo’s vaccines save the lives of children around the world, the consequences of a shortage could cause serious damage to the PharmCo brand image. Since there were no signs the customer knew of this looming supply shortage, we wanted to position ourselves as consultants by bringing this news to light. Our mission: to create a sufficient level of concern and urgency to translate into demand and, eventually, to demonstrate that SAFC could be the life preserver PharmCo needed.

The first thing we did was reach out to our day-to-day contact, the procurement representative. While he was thankful for the notification, he confronted PharmCo’s existing serum supplier, who issued a flat denial. This hurt our credibility with the customer, who immediately blocked our access to all its internal executives. But we had confidence in our information – and the dangerous and costly supply disruption this information represented – so we refused to take “no” for an answer. Using customized data in our 5600 blue software tool, we and our marketing team accurately quantified the financial impact of a potential serum shortage, crafting a well written and compelling e-mail to the customer’s franchise head and the quality lead, urging them to act. Did we know that bypassing our designated procurement contact risked damaging the relationship?

Yes, but we decided the stakes were too high not to press forward. It took us three tries before we finally caught the attention of the head of franchise, who granted us a meeting. Not only did this data pique her interest, but it led to a series of meetings over the next few months that gave us the opportunity to compete head-on for PharmCo’s vaccine dollars.

2. Create Value

Decision support: Leading the customer decision

We went to work preparing for our meetings, which now included a handful of decision makers who spanned all functions within the account, including personnel from strategic, initiative and operational levels. At every meeting we had the same agenda: to put in front of each stakeholder objective decision criteria (biased toward our SAFC solution) that would assist them in making a better decision. During these meetings we consistently wore our “consultant hats,” avoiding sales altogether.

We also prepared information about the account’s alternative, i.e., our competitor, to call attention to our key differentiators in order to educate and inform our contacts. Using our customized data in 5600 blue’s value blueprint tool, we prepared a comprehensive list of decision criteria. We analyzed what we knew about the competition’s access to raw materials, their relationship, their financial strength and more. And then we analyzed whether each decision criteria was of value to the customer. We had numerous conversations with the customer over the course of months to verify our internal work. Key conclusions targeted our areas of strength, such as existing supply chain and warehousing, but also our risks, such as our limited ability to impact the market and our inferior position on cost (Fig. 2).

We knew that to have any chance of winning, we needed to serve up a solution that met PharmCo’s needs with higher confidence and lower risk compared to their alternative to us. We knew that time was of critical importance and that we were best positioned to offer a short qualification time. We used this and our ability to stabilize the market as key differentiators to offset our weakness on price because we were not the lowest-cost provider.

3. Capture value

Trades

Continuing to organize and plan our strategy internally, we took these areas of high importance to our customer and translated them into specific deal components. We ranked those that were of high value to the customer and low cost to us, and vice versa. Where possible, we attempted to quantify the value of each of these components to expand the value of the overall deal. We call these trades.

Ultimately, we believed that the idea of trading for something of equal or greater value would avoid value-detracting concessions and expand the overall opportunity for everyone. This helped our SAM team capture and protect our value. In our value blueprint tool, we have a list of approved trades in a drop-down menu. This exercise jumpstarted our planning and helped us think more creatively beyond common products, services and terms. The tool also helped organize our internal thinking before we were ready to present ideas to the customer, with the goal of expanding the financial “pie” by adding in as many value-creating elements as possible.

Unlike in previous negotiations, the decisions to protect or concede individual pieces of value were made systematically, not ad hoc. This came in handy when our account’s purchasing contacts exerted concessions pressure during the negotiation. Instead of muddling through, we were ready to respond with prioritized trades thoughtfully prepared ahead of time by the SAM team. But we’re getting ahead of ourselves…

Multiple solution options

We continued to differentiate ourselves by presenting three options, rather than the standard take-it-or-leave-it proposal. These options outlined business relationships we could have with PharmCo focused not on price but on strategic solutions that would solve their business issues. The goal was to help the buying team organize their thinking around what THEY wanted, while deftly guiding them to the decision that WE wanted.

Look at Figure 3 below to see how this worked in practice. Notice the items in red; these are trades that both sides wanted, so we paid special attention to them. Presenting our customer with options marked a break from tradition and so naturally bred internal pushback. Faced with multiple options, the customer would simply take the lowest-cost option – or so the team feared. But as you’ll see, this isn’t what happened.

The multiple solution option concept helped our team structure, package and present our value in the form of business relationships. The relationships are populated with the appropriate trades that create the recipe for each particular solution. The concept also lends itself to a clean and concise format, and sends a flexible and creative message to customers operating in a business world where our own sales organization precedents – not to mention those of our competition – tend to offer the exact opposite.

More specifically, our fees in each option are set based on the terms and conditions, plus other variables, for that particular option. In other words, all deal components are intrinsically tied together. If the client wants to negotiate fees, then we have to adjust the other variables. It’s not that we’re being inflexible; on the contrary, we’re being logical and rational. Rather than setting ourselves up for a line item negotiation, we’ve built three risk/reward packages meant to be taken in their entirety.

How did our team react?

So how did our team respond to this new-to-us negotiation strategy? Our team struggled most with the transition because they were used to the buyer hitting them one line at a time. What helped was to include messaging the team could use during the customer presentation around a total risk/reward package. With risk (i.e., terms and conditions) and reward (i.e., price, products and services) becoming interdependent, it becomes incumbent on us to provide the story and explain this view to the customer.

On the messaging front, we don’t present the customer with “options A, B and C” or “options 1, 2 and 3” anymore. Instead, we name each option based on the problem it solves and the unique differentiated value it offers. We are no longer worried about the customer cherry picking, because we realize it is bad only when we give in to their demands. Cherry picking is just another form of sensitivity analysis because, based on those demands, we can perform a (often necessary) refined discovery.

With three options on the table, we went back and forth with the customer until agreeing on a fourth option, which very closely resembled the “best cash value” option. We prepared for what felt like an inevitable price pushback, but it didn’t materialize. Instead, the customer asked us to absorb both the risk and cost of unused supply, but our management stood its ground. We linked the portion of risk the customer agreed to absorb to the amount of serum we would commit to produce. By guiding the discussion toward value, we successfully avoided any discussion on price.

Commercial Outcomes

We can claim the following successes as a result of implementing our Precision-Guided Selling initiative:

• Following two months of delay, the customer asked for an executive meeting with SAFC.

• SAFC agreed to support the customer in qualification and manufacturing ramp up while negotiating commercial terms.

• $8 million signed for 2015, with $20 million contracts for 2016 and 2017 under discussion

• Overall relationship with PharmCo has improved. Discussions are now very constructive and positive regarding all other SAFC products and services.

Key Learnings

If you were to ask me how I spent my summer of 2014, I would tell you, “Largely outside of my comfort zone!” I tried new concepts, new ideas, pushed back on my internal team, and pushed on the customer in multiple ways to get them to hear and evaluate our value message. We are on a good path forward to start consistently improving our skill set with our entire strategic account and sales teams. We have the support of a strong cross-functional team representing sales, marketing, finance, legal and operations that will continue to help us get this right.

About the authors

Benjamin Shoham, Ph.D., spent the first two decades of his career developing life-saving medical technology for the biotechnology and pharmaceutical industries before being hired by SAFC, the commercial division of Sigma-Aldrich.

Carrie Welles is a seasoned sales executive with a majority of her career centered on the strategic/global account management profession. She is a partner at Think! Inc., and 5600blue.

This article was originally published in Vol. 17, Issue 3, 2015 of Velocity Magazine. For more articles like this and to have full access to all the articles for SAM, KAM and GAM practioners in Velocity, become a member of SAMA.